non filing of income tax return notice under which section

Petitioner made false statement and signed false verification and it is an offence punishable under Section 277. Under this section details of non-filing of Income tax returns will be furnished.

How To Submit Income Tax Return After Notices 114 4 Or 182 2 Urdu Hindi Javed Tech Master Tax Return Income Tax Return Income Tax

You get a defective return notice under section 1399 of the Income Tax Act.

. Is your 10-digit customer number. If the taxpayer fails to comply with all the terms of a notice issued under section 143 2 Thus Non-Filing of the Income Tax Return may result in the Best Judgement Assessment. For the amount above Rs30 Lakh tax is levied at the rate of 1.

For filing defective return If you do not file the income tax return in the correct form you will receive a defective return notice from the income tax department. Section 139 1 of the Income Tax Act 1961 prescribes the categories of the person who are required to file their return on or before the due date of filing return. In tax notice FBR may ask to reply within 30 days by submission of tax returns or to provide any particular reason of non-filing.

Income Tax Notice are in the form if intimation under section 1431 or proper Income Tax notice under section 1432 1421 148 or 245. If you have a genuine explanation for not filing and if the officer is satisfied with. You can respond to the notice of non-filing of returns via online channel.

Whereby required to file tax returns under sub-section 4 of section 114 of the Income Tax Ordinance 2001. Thus committed offence under Section 276 C 1 276 C 2 276 CC and 277 of the Income Tax Act 1961. You may have to pay a penalty of up to Rs.

Return under Section 1394c includes institutions that are compulsorily required to file tax return if the amount accumulated by the institution exceeds the maximum allowable limit. An Income Tax Return is mandatorily required to be filed if the Total Income is more than the minimum amount which is exempted from the levy of tax. Under section 1421 the Assessing Officer can issue notice asking the taxpayer to file the return of income if he has not filed the return of income or to produce or cause to be produced such accounts or documents as he may require or to furnish in writing and verified in the prescribed manner information in such.

Compulsory filing of Income Tax Return Conditions notified. Notice for Non-Payment of Self Assessment Tax. How to reply to non-filing of Income Tax Return Notice AY 2019-20.

Once received you need to respond to it within 15 days from the date of receiving the notice. The first home that individual holds is exempted from any tax. Section 1394c and Section 1394D are intended to deal with certain institutions who are claiming benefits according to the Section 10 of the Income Tax Act 1961.

In case of non-filing of return a notice under section 1421 is issued mentioning to file the return. Income Tax Intimation Under Section 143 1 Learn By Quickolearn By Quicko How To Reply Notice For Non Filing Of Income Tax Return. Upon successfully log in to the account click on the Compliance Tab.

Select the checkbox on the right hand side for Verification of Nonfiling. IRC 6651 a 1 imposes a penalty for failure to file a tax return by the date prescribed including extensions unless it is shown that the failure is due to reasonable cause and not due to willful neglect. The income tax department may issue a notice under Section 271F for not filing ITR.

Jewelry is valued at the market price whereas the valuation of the second house is. Complete Lines 1 4 following the instructions on page 2 of the form. You may still receive a notice for non filing of ITR even if you were not required to file your ITR.

All groups and messages. The assessee need to address the tax notice and reply accordingly within specified time limits. A company or a firm.

Furnish the appropriate reasons for not filling the Income Tax Returns. Please prepend a zero to your student ID ie. See IRM 20123 Failure to File a Tax Return -.

Any person other than a company or firm if his total income during the. How To Respond To Non Filing Of Income Tax Return Notice All About Notice U S 143 1 A And How To Deal With It Myitreturn Help Center. Petitioner concealed his true and correct income by not filing return of income not paying the advance tax and the demand tax.

Under the compliance tab click on View and Submit my Compliance option. FBR also issuing tax notices under section 1144 for submission of tax returns under a given period of time. 5000 for missing the deadline.

For filing the wealth tax valuation of the property needs to be done and for this help can be taken from government approved valuers. This article focuses on such cases wherein you may receive a notice for non-filing of ITR. In the year or period requested field enter 12312017 for the 2019-20 AY.

Irs Letter 4364c Amended Return Notification H R Block

Pin On Taxation And Business Software

How To Handle Notices From The Income Tax Department Income Tax Income Tax Preparation Filing Taxes

Income Tax Non Compliance Notice 2015 Income Tax Income Tax Return Income

Irs Notice Cp75 Exam Initial Contact Letter Eic Entire Refund Frozen H R Block

Irs Notice Cp80 The Irs Hasn T Received Your Tax Return H R Block

Section 206aa Of The Act Does Not Override The Provision Of Section 92 Of The Income Tax Act Taxact Income Tax Income

Filing Of Audited Or Un Audited Accounts As Well As Tax Planning Is Very Important The Inland Revenue A Filing Taxes Tax Filing Deadline Financial Statement

Receiving An E Mail Intimation Or Notice From The I T Dept Is A Scary Proposition For All Of Us However These Intim Financial Advice Income Tax Return Taxact

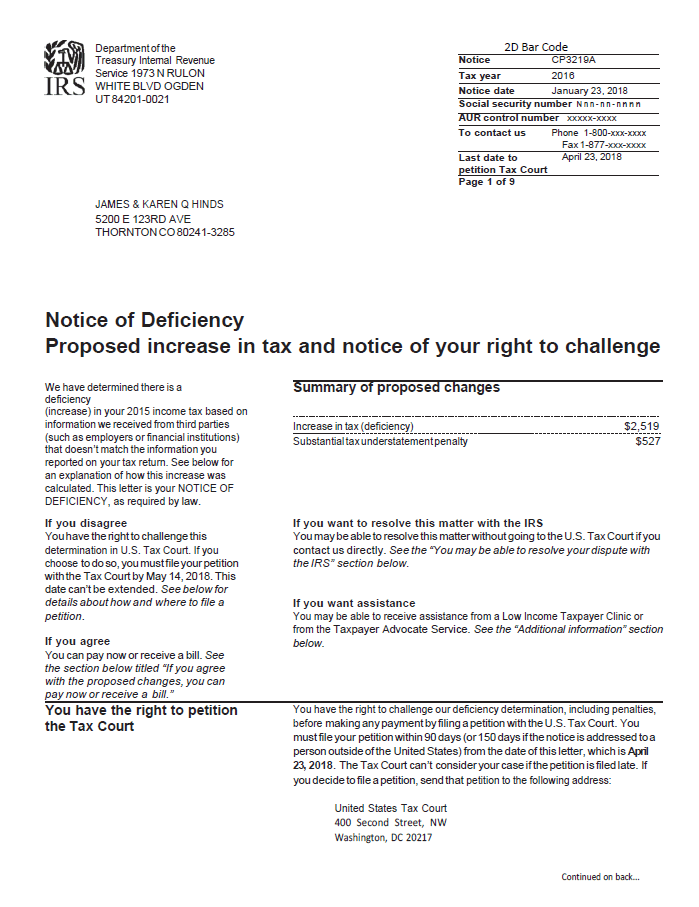

Notice Of Deficiency Overview Irs Forms Options

Irs Letter 707c Refund Or Return Delayed In Processing Refund Forthcoming H R Block

/cloudfront-us-east-1.images.arcpublishing.com/gray/L6QOIUO7NRFJ3ENZ4A52GTLCKU.bmp)

Don T Toss These 2 Important Stimulus And Child Tax Credit Letters From The Irs

Accounting Taxation Ignore Income Tax Notices With Simple Tips Income Tax Income Tax Return Tax

:max_bytes(150000):strip_icc()/IRSForm4506Page1-b54ccd93aa56416595fe32b49d670d67.jpg)

Form 4506 Request For Copy Of Tax Return Definition

What Is A Cp05 Letter From The Irs And What Should I Do

Irs Tax Notices Explained Landmark Tax Group

Dividend Taxability Page No 2 Taxact Dividend Income Tax

Irs Letter 4903 No Record Of Receiving Your Tax Return H R Block