nc sales tax on food items

Dare County collects a 2 local sales tax the maximum local sales tax allowed. The Dare County North Carolina sales tax is 675 consisting of 475 North Carolina state sales tax and 200 Dare County local sales taxesThe local sales tax consists of a 200 county sales tax.

Pin By Xinedonovan On 2021 Tax Receipts Card Holder Credit Card Cards

75 is the highest possible tax rate cedar grove north carolina the average combined rate of every zip code in north.

. On top of the state sales tax there may be one or more local sales taxes as well as one or more special district taxes each of which can range between 0 percent and 275 percent. Counties and cities in north carolina are allowed to charge an additional local sales tax on top of the north carolina state sales tax. In North Carolina grocery items are not subject to the states statewide sales tax but are subject to a uniform 2 local tax.

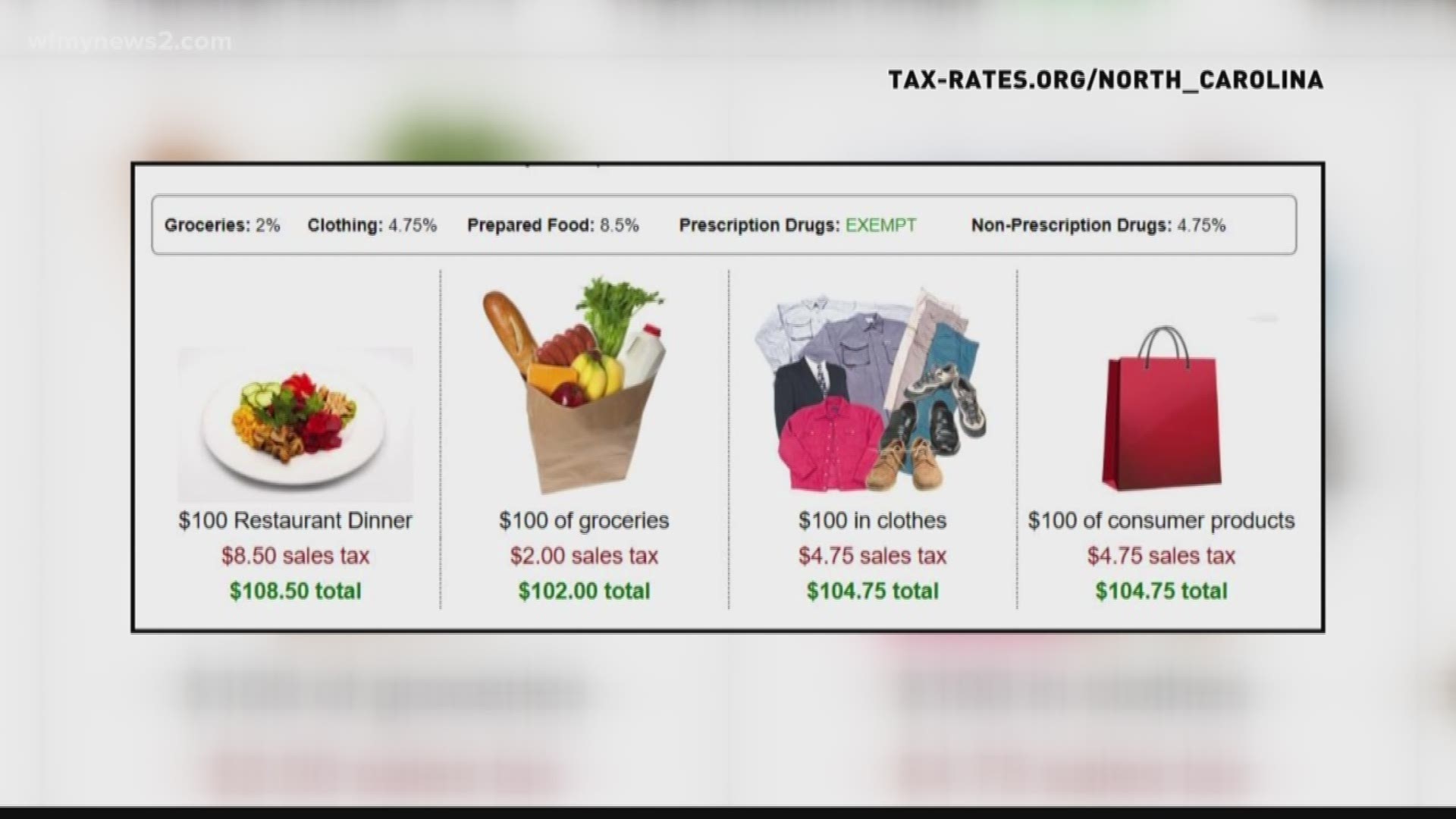

North Carolina sales and use tax law provides an exemption for sales of mill machinery machinery parts and manufacturing accessories however these items are subject to a 1 privilege tax with a maximum tax of 80 per article until June 30 2018. Retail Sales Retail sales of tangible personal property are subject to the 475 State sales or use tax. What is NC sales tax on restaurant food.

Sales Tax On Grocery Items Taxjar. Of Revenue Certificate of Registration. The North Carolina state legislature levies a 475 percent general sales tax on most retail sales within the state including prepared foods and beverages in restaurants.

California 1 Utah 125 and Virginia 1. According to North Carolina law youd be required to charge the full Murphy NC sales tax amount of 7 475 NC state rate and 225 Cherokee County rate on the toothbrush and the candy. FY2004-05 FY2005-06 FY2006-07 FY 2007-08 FY 2008-09 I n M i l l i o n s Prepared Food Food Source.

We include these in their state sales. 31 rows The state sales tax rate in North Carolina is 4750. The Dare County Sales Tax is collected by the merchant on all qualifying sales made within Dare County.

North Carolina Department of Revenue 11509 Page 2. Search local rates at TaxJars Sales Tax Calculator Any food items ineligible for the reduced rate are taxed at the regular state rate. Is Food Exempt from Sales Tax.

What transactions are generally subject to sales tax in North Carolina. North Carolina has recent rate changes Fri Jan 01 2021. North carolina 475 4 north dakota 5 ohio 575 oklahoma 45 oregon none -- -- --pennsylvania 6 rhode island 7 south carolina 6 south dakota 45 tennessee 7 4 4.

Sales Tax Treatment of Groceries Candy Soda as of July January 1 2019 a Alaska Delaware Montana New Hampshire and Oregon do not levy taxes on groceries candy or soda. The 475 general sales rate tax plus local taxes including the transit and Article 46. As of January 1 2018 candy and soft drinks will be.

Arkansas Grocery items are not tax exempt but food and food ingredients are taxed at a reduced Arkansas state rate of 15 any local rate. Manufacturing Items Sales of the following. Exemption for Packaging Items for Food and Prepared Food Under a Prepaid Meal Plan 7-21-16.

A customer living in Cary North Carolina finds Steves eBay page and purchases a 350 pair of headphones. Sales Tax Collections on Food and Prepared Food In Millions 1087 1129. The sales tax rate on food is 2.

Currently combined sales tax rates in North Carolina range from 475 percent to 75 percent depending on the location of the sale. To collect sales tax from their customers. Exemptions to the North Carolina sales tax will vary by state.

PO Box 25000 Raleigh NC 27640-0640. To learn more see a full list of taxable and tax-exempt items in North Carolina. The North Carolina sales tax rate is 475 as of 2022 with some cities and counties adding a local sales tax on top of the NC state sales tax.

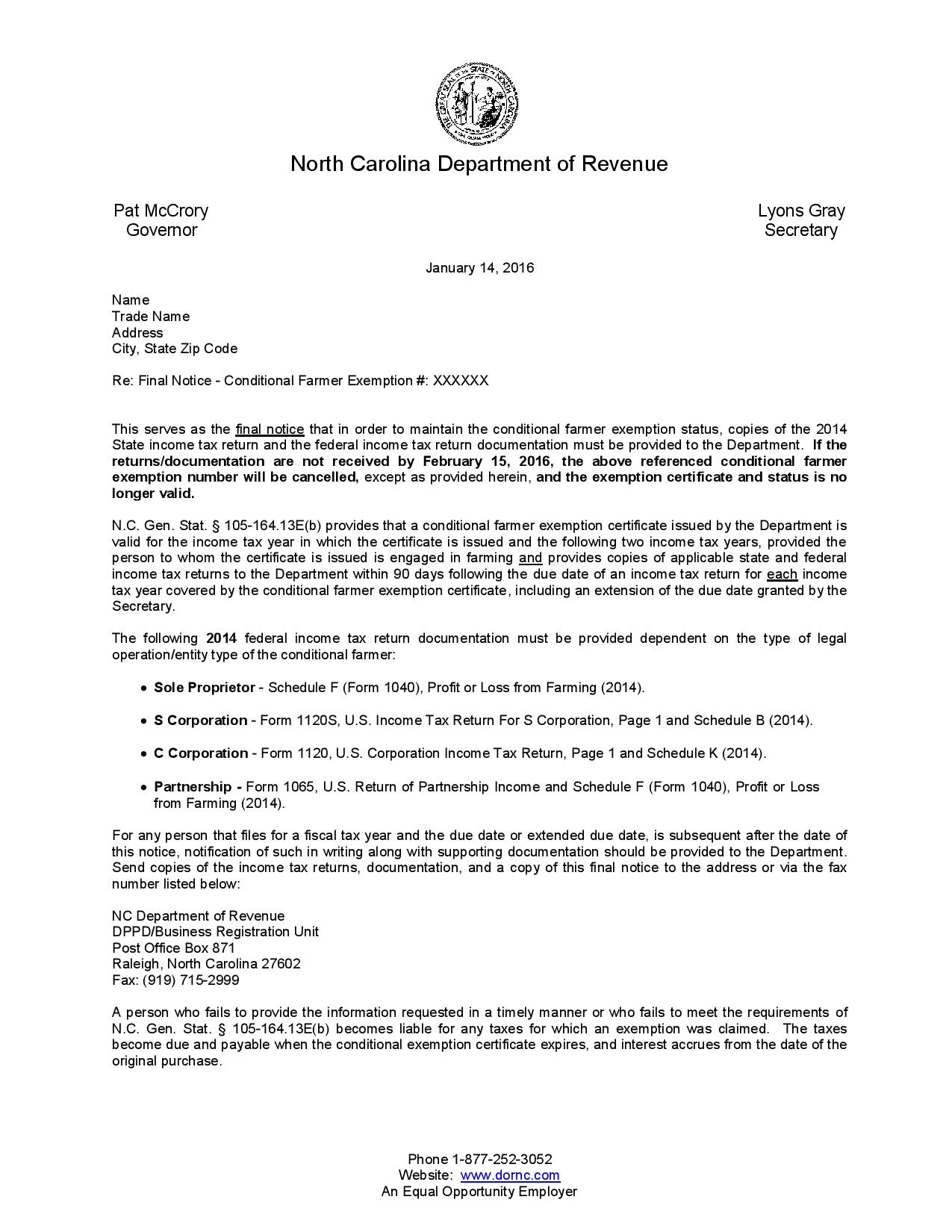

The State and applicable local sales and use tax. Lease or Rental of Tangible Personal Property. Those who sell items other than unprocessed agricultural products they actually produce must now provide the farmers market manager a copy of their NC.

This tax chart is provided for the convenience of the retailer in computing the applicable sales and use tax of Food. 105-164328 and reads as follows. North Carolina Department of Revenue.

Nc sales tax on food items. At a total sales tax rate of 675 the total cost is 37363 2363 sales tax. The 2013 legislation makes no change for this situation.

Purchases food items and combines two or more of the items in a package or gift box for sale as a single item the gift box containing food items does not constitute prepared food North Carolina Department of Revenue 11509 Page 3. The information included on this website is to be used only as a guide. It is not intended to cover all provisions of the law or every taxpayers specific circumstances.

Some examples of items that exempt from North Carolina sales tax are prescription medications some types of groceries some medical. Items subject to the general rate are also subject to the 225 local rate of tax that is levied by all counties in North Carolina. Walk-ins and appointment information.

Qualifying Food A 200 local rate of sales or use tax applies to retail sales and purchases for storage use or consumption of qualifying food. In some states items like alcohol and prepared food including restaurant meals and some premade supermarket items are charged at a. In the state of North Carolina sales tax is legally required to be collected from all tangible physical products being sold to a consumer.

Food is exempt from the State portion of sales tax 475 but local sales taxes Articles 39 40 and 42 do apply to food to make up a 2 sales tax on food. Select the North Carolina city from the list of. Food Tax The 2 Food Tax.

B Three states levy mandatory statewide local add-on sales taxes. Bakery items sold with eating utensils soft drinks and candy. With local taxes the total sales tax rate is between 6750 and 7500.

When calculating the sales tax for this purchase Steve applies the 475 tax rate for North Carolina plus 2 for Wake Countys tax rate and. But youd only charge the uniform reduced rate of 2 local tax on the loaf of bread. While North Carolinas sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes.

Sales taxes are not charged on services or labor. The 1 privilege tax has been repealed effective June 30 2018 by Senate Bill 257 from the 2017. Sales and Use Tax Sales and Use Tax.

This page describes the taxability of food and meals in North Carolina including catering and grocery food. A customer buys a toothbrush a bag of candy and a loaf of bread. Food Non-Qualifying Food and Prepaid Meal Plans.

2004-2009 Statistical Abstract North Carolina Department of Revenue Tables 32 56 and 57 in most publications.

Verify Yes Sales Taxes Are Different For Different Foods Wfmynews2 Com

Online Rebates Round Up Select States The Harris Teeter Deals Rebates Entertaining Essentials Snack Items

Sales Tax On Grocery Items Taxjar

What A Time Shirt Rose Foods Tee Shirt Designs Shirt Design Inspiration Graphic Tee Design

Tax Free Week Starts Today For Hurricane Supplies Be Prepared Now Instead Of Waiting Until A Storm Is Hea Plastic Drop Cloth Hurricane Supplies Disaster Prep

Tax Free Weekend Guide By State 2021 Direct Auto

Tax Haven Offshore Bank Offshore

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Blank Receipt Template Sample Printable Receipt Form 10 Free Documents In Pdf Fpkuo Templates Printable Free Receipt Template Free Receipt Template

Is Food Taxable In North Carolina Taxjar

Is Food Taxable In North Carolina Taxjar

Is Food Taxable In North Carolina Taxjar

64 Dollar Grocery Budget Harris Teeter Grocery Budgeting Budget Food Shopping Harris Teeter

Sales Tax Exemption For Farmers Carolina Farm Stewardship Association

Saving On School Lunches Our Favorite Lunchbox Hacks Lunch Box Hacks School Lunch Lunch Box

Is Food Taxable In North Carolina Taxjar

Pin On Events At Raffaldini Vineyards

Gameday Ncsu Women S Boot Ncs L052 1 Womens Boots Boots Gameday Boots